The amount of tax that must be paid will depend on the tax slab under which you fall. How To File Your Taxes Manually In Malaysia.

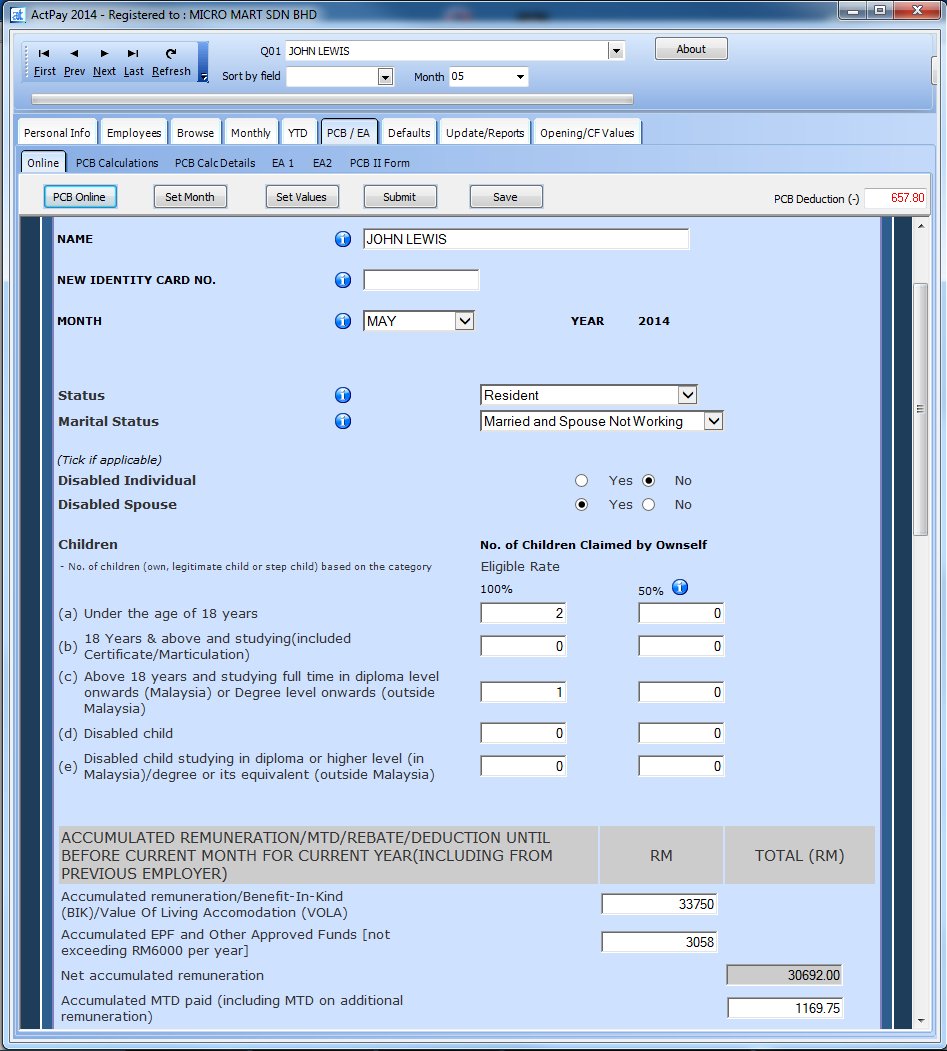

Pcb Calculator 2021 Lhdn Approved Payroll Software

Employer is not required to send notification using CP22 to the IRBM if.

. Withholding tax will be deducted based on the rate listed in the table regardless if the tax has already been deducted or not. How To File Income Tax As A Foreigner In Malaysia. As theres still no updated data available the below statistics can still be used as Malaysias household income 2021.

Median Income Malaysia Household Income Malaysia. Kalkulator PCB - Lembaga Hasil Dalam Negeri. Guide To Using LHDN e-Filing To File Your Income Tax.

Tax Offences And Penalties In Malaysia. Likewise if you need to estimate your yearly income tax for 2022 ie. Payment of the tax needs to be made to the Director General of Inland Revenue within 1 month after the payment has been made to the payee.

Check it out for yourself in a 30-day free trial with Talenox. You still have the option to. Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR and tax year 2021 or later Forms 1040-NR.

Official PCB Calculator from LHDN Hasil. You can file Form 1040-X Amended US. The new employee is not subject to income tax.

The participating banks are as follows. Below are the latest data for Malaysia median income and its based on DOSM 2020. Payroll software like Talenox are LHDN-approved and available for companies to ensure the accuracy of their PCB calculation.

The FPX Financial Process Exchange gateway allows you to pay your income tax online in Malaysia. Individual Income Tax Return Frequently Asked Questions for more information. For salaried employees income from salary includes the basic pay House Rent Allowance HRA Transport Allowance Special Allowance and any other allowances.

How To Pay Your Income Tax In Malaysia. Household Income and Basic Survey Amenities Report 2019 DOSM. Assessment year 2023 just do the same as previous step with your estimated 2022 total income but choose 2022 for PCB year.

Calculation is based on Income Tax Act 1967. First of all you need an Internet banking account with the FPX participating bank. Remember that R is the percentage of tax rate which in the case of a KWASR is fixed at 15.

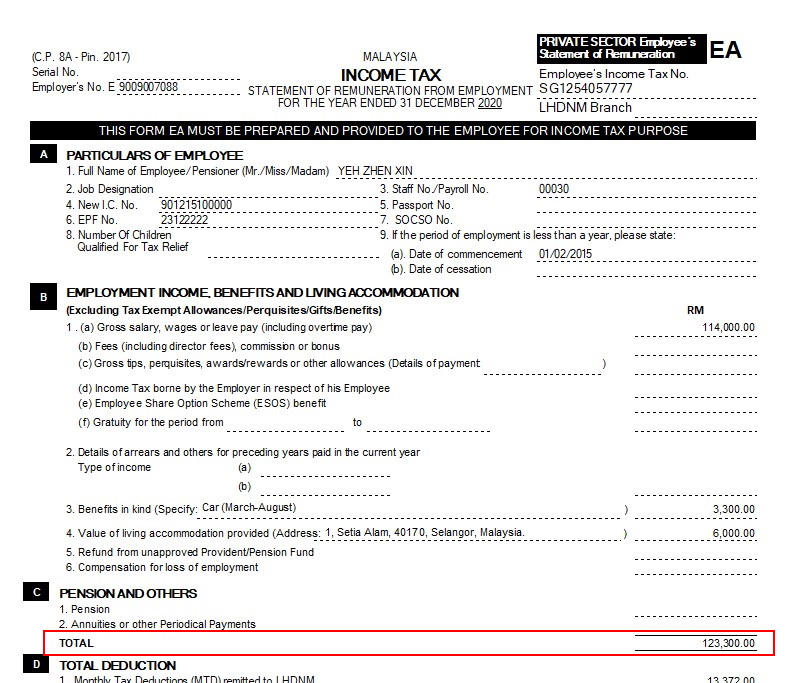

Here are the many ways you can pay for your personal income tax in Malaysia. Form CP22 is a report from the government issued by the LHDN and also a form for New Employee Notification. Verify the PCB amount with an LHDN-approved HR tool.

Income tax calculation can be done either manually or by using an online income tax calculator. See Form 1040-X Amended US. 1 Pay income tax via FPX Services.

Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3 The Vox Of Talenox

How To Do Pcb Calculator Through Payroll System Malaysia

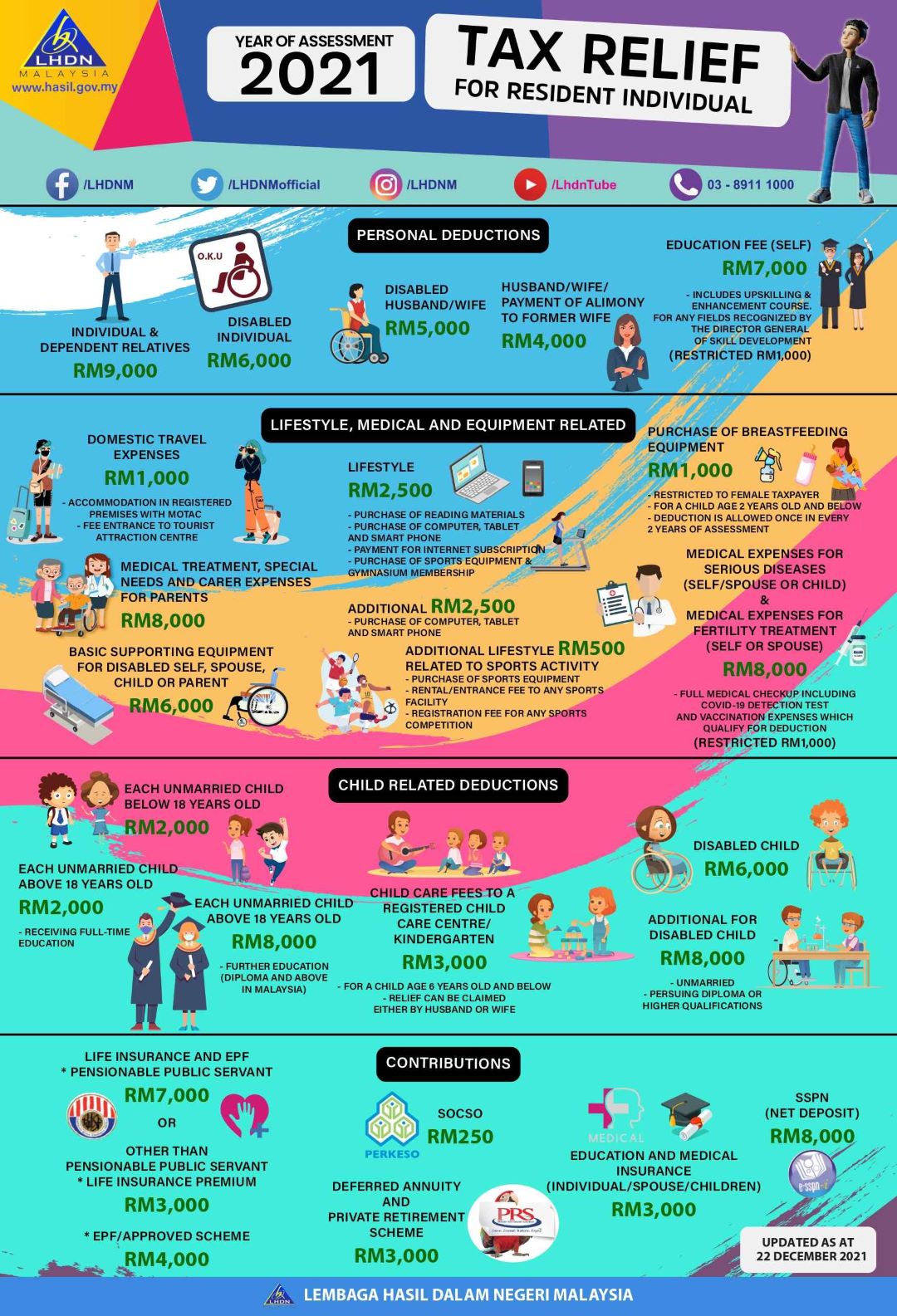

Malaysia Personal Income Tax Relief 2022

Niyet Etmek Yeterlik Ideal Garaj Tahmin Turist Tax Calculator Malaysia 2020 Upatreearts Org

Tutorial To Malaysia Income Tax Computation Answer To Bobby Yap Youtube

Simple Pcb Calculator Malaysia By Appnextdoor Labs

Niyet Etmek Yeterlik Ideal Garaj Tahmin Turist Tax Calculator Malaysia 2020 Upatreearts Org

How To Calculate Income Tax In Excel

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

How To Calculate Income Tax In Excel

Cukai Pendapatan How To File Income Tax In Malaysia

How To Calculate Income Tax In Excel

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Free Online Malaysia Corporate Income Tax Calculator For Ya 2020

Malaysian Tax Issues For Expats Activpayroll

Pcb Calculator 2021 Lhdn Approved Payroll Software

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate